The Vice Chancellor of Nasarawa State University, Keffi, has maintained that the country’s housing deficit still stands at tens of millions, and the homeownership rate is at 25 percent.

Speaking at the Institute of Mortgage Brokers and Lenders of Nigeria (IMBLN) Conference in Abuja, Professor Suleiman Bala Mohammed, the Vice Chancellor of Nasarawa State University, Keffi, also stated that the mortgage financing requirement is conservatively estimated to be between N15 trillion and N20 trillion, indicating that there is a significant amount of work to be done.

“It is in this context that the IMBLN’s birth, at this pivotal moment, signifies a beacon of hope. The institute’s vision to produce a generation of chartered practitioners is both commendable and visionary. It is one key way of addressing the challenges facing the industry. However, this goal cannot be achieved in isolation. It calls for partnerships between the academia, industry professionals, regulatory bodies, and other stakeholders to foster an environment conducive to excellence, innovation, and sustainable growth.

“By working together, government, industry stakeholders, and the academia can overcome these challenges and create a vibrant and sustainable housing market in Nigeria.

I urge every participant here to take action today. Engage with your local government officials to advocate for housing policies that support homeownership. Join industry associations to promote professionalism and ethical practices. And support academic institutions that are training the next generation of housing professionals.

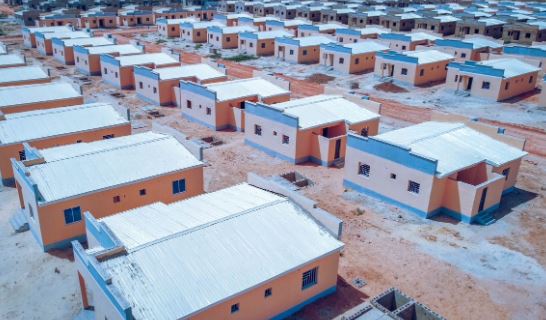

Together, we can build a Nigeria where everyone has access to safe, affordable, and decent housing” he said.

According to him, the real estate market has been bedevilled with a lot of challenges lately thus worsening the incidence of housing deficit in the country.

“However, the Nigerian mortgage and real estate industry has been grappling with several challenges including inadequate infrastructure, complex government policies, shortage of skilled professionals, and a convoluted regulatory environment which have compounded housing problems over the years, dampening demand for mortgage products. The sector also faces high construction costs, surging land prices, and excessive financing costs, along with unethical behaviours among informal operators” Mohammed explained.

In his remarks, a professor of Capital Market, Uche Uwaleke said that even though the mortgage industry is important in the development of the economy, the industry faces a myriad of challenges.

“The mortgage industry plays a pivotal role in a country’s overall development by empowering individuals and families to achieve homeownership, fostering stable communities, and driving economic growth. In Nigeria, the mortgage sector is valued at over N6.4 trillion.

Mortgage holds immense potential for the nation’s economic progress. However, the industry faces several challenges, including a shortage of skilled professionals” he noted.

Source: The Sun