The article is written by Rusmir Musić, Upstream Operations Officer, IFC, assisted by Autif Sayyed, South Asia Lead, Green Building Program, IFC and Nandita, Education Consultant, Green Building Program, IFC

January 4, 2022

Given the global pandemic, sustainability is no longer a choice, but essential for future resilience. Going forward, investors, owners, architects, and engineers need to focus on sustainability as a key criterion for decision making. Or else, their buildings may soon become obsolete. With new government regulations, more investment choices, and end users preferring sustainable or “green” projects, green buildings make perfect business sense. Despite the potential, in 2020, only about 3 percent of new construction in India was independently certified as green. In India, one of the main factors preventing large-scale uptake of green buildings is financial, including the perception of high incremental costs, uncertainty regarding operational savings, and limited access to finance.

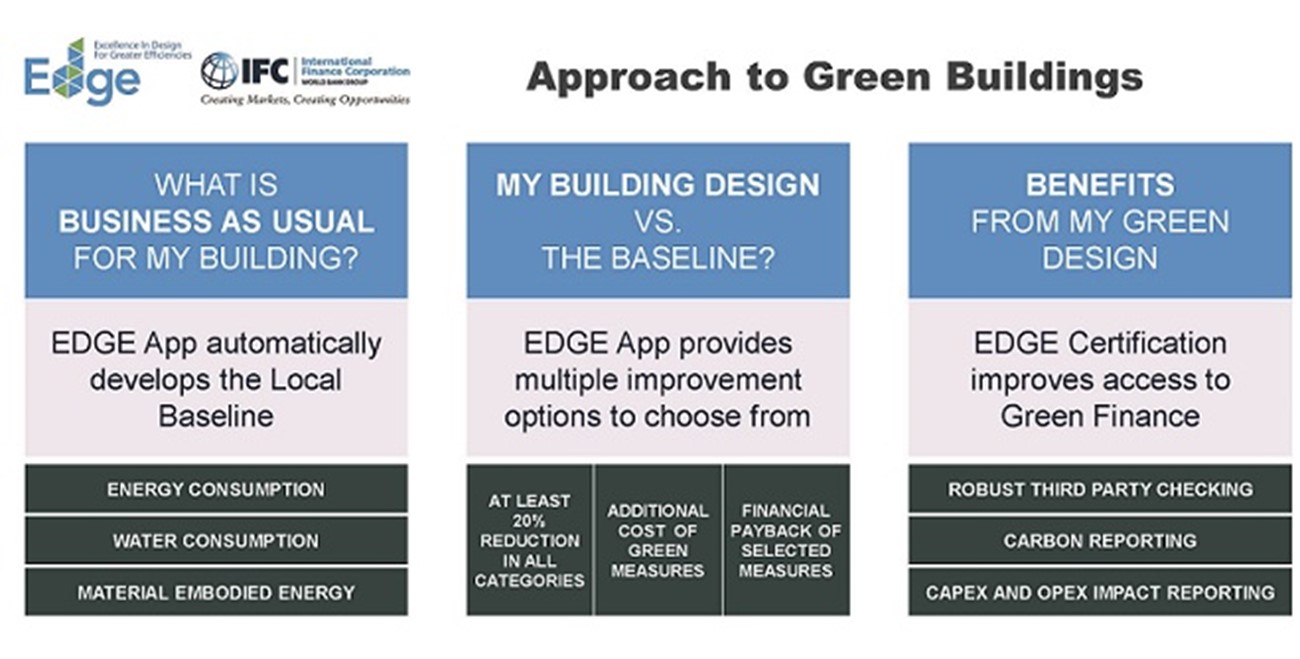

To address this gap, the International Finance Corporation (IFC), a member of the World Bank Group, has developed a new approach through its EDGE (Excellence in Design for Greater Efficiencies) certification program. A free online app (www.edgebuildings.com) offers optimized financial planning of a green project in which the approximate incremental cost, expected operational savings, emissions reduction, and the payback period can be instantly calculated based on the efficiency measures one chooses. This can transform sustainable construction into a viable and cost-efficient proposition. Aligned with most international climate investment reporting standards, EDGE certification offers avenues for green finance from local and international investors.

IFC estimates that, in India, the total investment opportunity in the green building sector until 2030 is INR 10676 crore ($1.4 billion)—a large chunk of which is in the residential sector. In fact, massive demand for houses, especially affordable homes, is driving the recovery of the construction sector. Government initiatives such as the Pradhan Mantri Aawas Yojana (PMAY) are further catalyzing this growth. To meet the high market demand, we need sustainable mechanisms for financing.

Among the drivers listed in figure 2, green finance is more like a jigsaw puzzle, as the following example illustrates.

Colombia Construction

The Colombia case study shows how green residential construction can grow rapidly with the right combination of green finance, technical assistance, and awareness. In 2017, Colombia had only one residential building certified as green. Four years later, according to IFC estimates, over 20 percent of all new building construction in the country are certified as green, with green housing playing a key role. The green buildings market accelerated when two commercial banks, Bancolombia and Davivienda, launched green investment programs for newly built housing, which included the following:

• Common green standard: the banks adopted IFC’s EDGE as the basis for green eligibility.

• Incentivized loans for developers.

• Education campaign for developers.

• Partnership for mortgages: developers introduce home buyers to banks, which provide preferential mortgage rates based on certificates issued to each home.

• Green mortgages with discounted mortgage financing rates.

As of September 2021, Colombia has 63 million square feet (5.9 million square meters) of certified green real estate (either already constructed or in progress) and close to 73,000 green homes, of which two-thirds are affordable housing.

The above program components were possible on fully commercial terms, without grants or concessional finance. Bancolombia could offer lower rates because of its ability to raise lower-cost financing through green building certification labels, enabling the green bond approach. Following the Paris Climate Agreement, access to international green finance is becoming an important source of financing for local banks and developers. Currently, the demand for qualified green projects is far greater than the supply of available projects. The United Nations tracks more than 1,100 investors and 5,000 companies with climate pledges and more than 10,000 cities with green programs while institutional investors have pledged $9 trillion in assets toward net-zero carbon emissions by 2050. Going forward, certified green buildings could help connect supply and demand through green finance, enabling better financing terms.

Recognizing the benefits, many local and international lenders are launching green financial products such as green home loans, with some even offering additional incentives. For example, Reall, a UK-based affordable housing investor, found that although local developers were keen to build green, they lacked a standardized approach. In response, offering technical assistance, along with preferential finance rates, can allow a timely shift to a green portfolio, with commercially viable homes starting at INR 6 lakh ($7,500). Reall is currently developing the EDGE-certified 800-unit Sanand housing project in Ahmedabad, along with its Indian partner, Janaadhar.

In India, Housing Development Finance Corporation Limited (HDFC Ltd)—the country’s largest housing finance company—offers special loans to buyers of green homes. In 2021, IFC provided an INR 1875 crore ($250 million) loan to HDFC Ltd, with at least 25 percent of the financing earmarked for green affordable housing. This will help the company grow its affordable housing and emerging green affordable housing portfolio by improving access to housing for people on low incomes. Aligned with the government’s goal to provide ‘Housing for All,’ the funding will also help generate jobs, accelerating economic recovery.

Quick Sales

Many developers access international green finance flows directly. In Mexico, Vinte launched a $38 mn green bond, which was oversubscribed by 50%, demonstrating the growing demand for green products among institutional and commercial investors. This allows Vinte to diversify its investor base and attract better financing.

Using green label as a market differentiator, developers are saving on their cost of financing through quick sales. In Vietnam, for example, Capital House sold homes 20 percent faster than average, reducing overall financing costs by 3 percent. This could be attributed to the expected 30 percent reduction in utility consumption, achieved with only a 1 per cent increase in construction costs. In Mexico, Casas Krea saw increased sales despite COVID-19. Both Casas Krea and Capital House utilized IFC’s free marketing toolkit to position their properties as certified green, gaining a competitive advantage and achieving quick sales. Lenders are starting to recognize that utility savings help improve a borrower’s risk profile, leading to potential financial innovations. According to a 2013 study by the University of North Carolina, buyers of green homes have a 32 percent lower likelihood of mortgage default. This is because they can use their utility savings toward loan repayment.

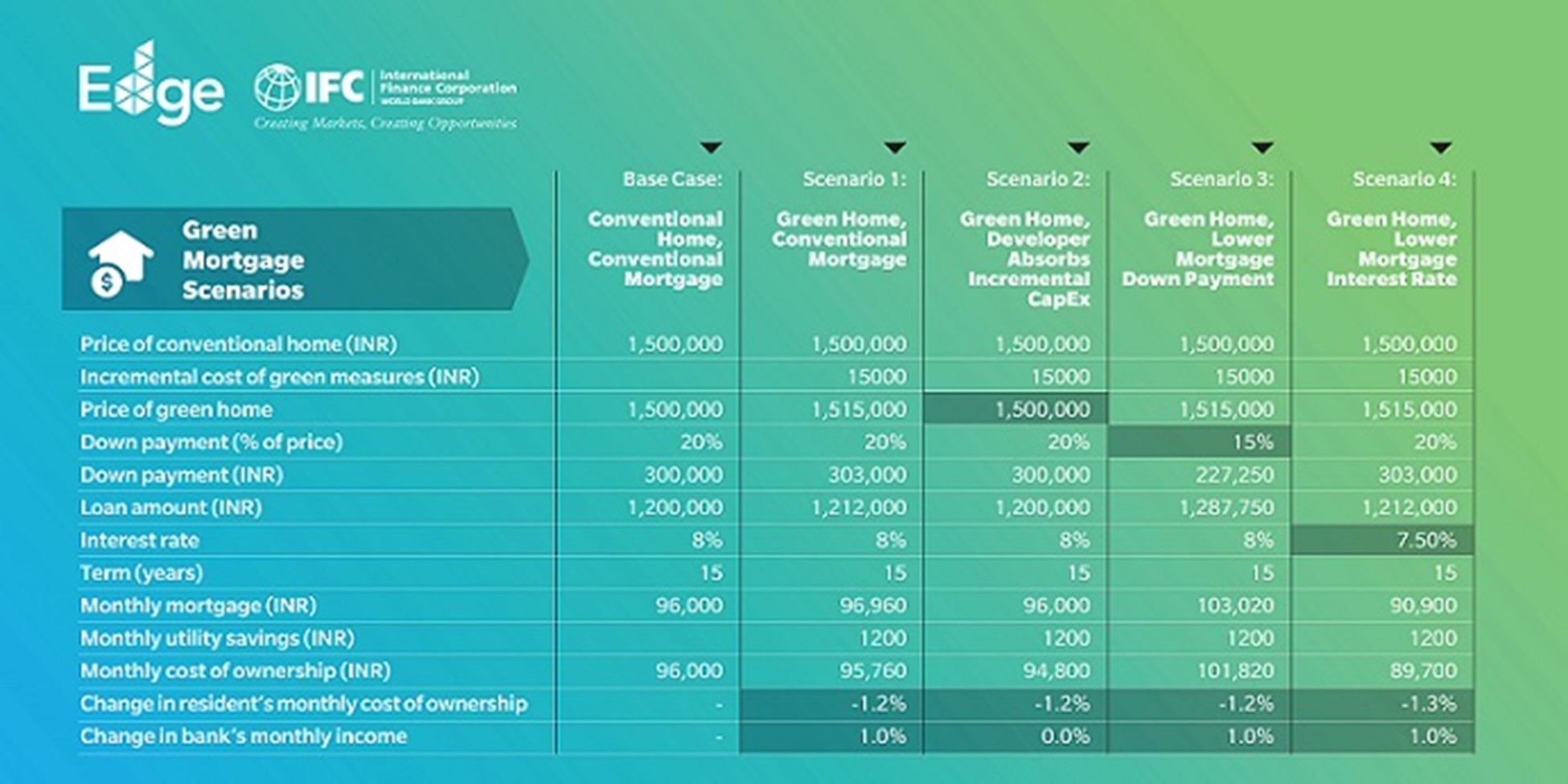

The above table illustrates the options available to increase the attractiveness of green homes by comparing a conventional home with alternative green home scenarios, all of which are based on actual green loan case studies from banks.

All the alternate scenarios are a win-win for banks—they receive higher monthly mortgage payments, except in scenario 2—as well as homeowners, with lower monthly out-of-pocket expenses.

With the promise of green finance in India, financial institutions are showing a growing appetite for green bonds and green loans. Green finance can help all relevant stakeholders, including developers, banks, and homebuyers. First, minimizing incremental costs through tools such as EDGE allows developers to construct green units at affordable rates. Second, utility savings from green homes enable banks to launch dedicated green mortgage products for homeowners. Finally, with access to green international finance flows, banks can ensure better financing terms, boosting their bottom line as well as strengthening their borrower profile as affordable housing is pivotal to India’s story of innovation, productivity, competitiveness, and inclusive economic growth.

Source: Construction Week