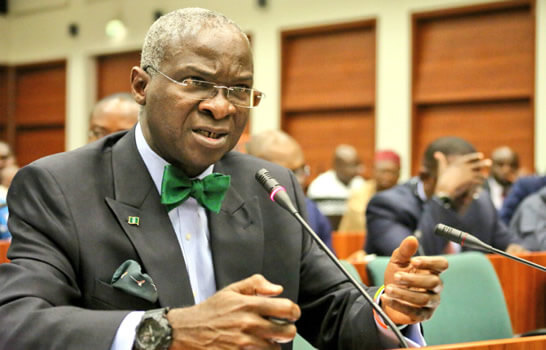

Minister of works and housing, Mr Babatunde Raji Fashola (SAN) , has said that the Federal Mortgage Bank of Nigeria (FMBN) under the administration of President Muhammadu Buhari has contributed positively to the development of the housing sector in Nigeria through commendable service delivery.

The minister said this yesterday at the opening ceremony of the 2022 Federal Mortgage Bank of Nigeria Board/ Management Retreat and unveiling of the bank’s new corporate statement with the theme: “Strategic Repositioning For Optimised Performance” with a sub theme: “Organisational Culture Change and Informal Sector Integration” held in Abuja.

Fashola said, ” Since the inception of the Muhammadu Buhari administration in 2015, the bank has a positive story of service delivery to tell with the number of mortgages that have been issued, housing schemes that have been funded and completed and changes that have been made to the eligibility conditions to improve access to funding.”

The minister said that the equity contribution ratio for certain types of loans have been reduced. He charged the bank to do more as the federal government has infused the board and management with a sense of how to reposition itself for greater and optimal performance to serve members of the public, especially those that contribute to the National Housing Fund.

Fashola stated that the federal government has supported the FMBN with the acquisition of core banking applications and software that reflect the reality of the current banking environment to enable them operate comfortably like any ideal bank.

He disclosed that the National Council on Housing and Land held last week in Sokoto adopted a recommendation for the bank to seek NDIC’s insurance of its contributors fund just as it is done for depositors in other banks.

Although the minister expressed appreciation for the services such as the issuing of mortgages, home refurbishment loans and the introduction of the Rent-to-Own Initiative, he charged them to think out other ways of easing other concerns of the people, especially the problem of two to three years rent payment demand by landlords in advance from tenants.

He observed that the problem of housing deficit is often seen from the angle of ownership whereas no country in the whole world has one hundred percent housing ownership, adding that it is a balance of ownership and rental.

While commending the management and board of the bank for organising the retreat, he urged them to focus their deliberations on how the people can be served better.

Earlier, the chairman of the bank’s board of directors, Mr Ayodeji Ariyo, disclosed that the decision to have the retreat underscores the irrevocable commitment of the board to provide the required leadership and strategic direction for a rapid and sustainable positive turn – around in all facets of the bank’s operations.

Ayodeji said the wellbeing of individuals and families is negatively impacted when the need for satisfactory housing is not met. This, according to him, leads to poor health, resulting in increased financial burden on the healthcare system, low productivity, low esteem and other bills.

In his opening address, the managing director/ chief executive officer of the bank, Mr Madu Hamman revealed that the COVID -19 global pandemic, the Russia – Saudi Arabia oil price and the Russia-Ukraine conflict have impacted negatively on the global economy which posed some challenges to the bank.

He, however, said despite that the bank has made remarkable achievements and is poised to record more.