Nigeria has a huge housing deficit. The demand for affordable homes far outstrips supply. In an Economic and Financial bulletin dated December 2019, The Central Bank of Nigeria (CBN) states that “a deficit of at least 17.0 million homes exists in Nigeria.”

The bulletin says that Nigeria requires about 700,000 housing units annually, spanning 20 years to accommodate the rising population.

According to Housing Finance For Africa, using annual income profile for rural and urban households based on the 2019 Purchasing Power Parity (PPP) measure, at $20,863 68% of Nigerians can afford a home costing under N5 million (calculation done with exchange rate $1 to 134.21).

Housing Finance for Africa states that “In 2020, price of cheapest newly built one-bedroom flat was estimated to be N2.8 million (US$8 040) in an urban area.” Suppose we assume it will cost just N5 million to deliver a two-bedroom bungalow in Nigeria.

In that case, the cost of delivering 700,000 homes is estimated at N3.5 trillion. For context, the Nigerian 2021 budget is about N7.9 trillion in revenues

In this article, I want to ask two questions:

- Can Nigeria build 700,000 new homes a year?

- If yes, how can these homes be funded?

Can Nigeria build 700,000 new homes a year?

The history does not look good. From 1972, when the 2nd National Housing Policy (NHP) was launched until 2012, less than 200,000 housing units have been delivered across the country. See Table 1.

Table 1. Number of Homes delivered by Federal Government 1962 to 1995

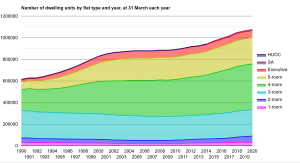

Nigeria could only deliver 74,604 housing units in 33 years, about 2,260 homes a year. In Singapore, the government delivered about 686,894 dwellings in 33 years, about 20,814 a year. The key to note for Singapore is the bulk of these homes are four bedrooms (see Figure 1).

In South Africa, under their Reconstruction and Development Plan (RDP), they delivered 2.3million homes in 13 years, roughly 176,923 homes a year. Perhaps Nigeria can shoot for 250,000 homes a year, using a volume cost of N5 million; this will cost about N1.25 trillion.

Figure 1 Number and type of homes constructed in Singapore

How do we fund N1.5 trillion for 250,000 affordable homes annually?

The government has to look at affordable housing as a social contract and not an immediate profit-generating venture. In South Africa, the government introduced a zero tax (transfer duty) policy on housing that cost less than R500,000 ($67,850) and 5% for units costing R500,000 and R1million. This is the mentality to have with affordable housing delivery.

Affordable housing is a collaborative effort, with the Federal, State, and Local Governments supporting the private sector to provide affordable housing for Nigerians. The first thing to do is reduce the overall cost of building a house. Then agree on a methodology and process to cycle funds into housing.

The total cost of a house is made up of these four main cost heads:

- Building materials; Cement, plumbing, and electricals.

- Land, cost of purchase, clearing, site, and services including drainage, fencing, surveys.

- Regulation and taxes; cost of transfers, taxes.

- Finance; interest cost of a mortgage.

The goal is to drop the cost of the homes, especially for high-cost areas like Lagos and Abuja. I will list suggestions under these headers.

1. Building materials

A Federal Minister of Lands, Housing & Urban Development once commented that “the high cost of conventional building materials, especially cement, is one single most important factor responsible for soaring housing costs in Nigeria.” This is true.

The Guardian reports that building material prices went up 300% in September of 2021, with 30% of the cost of a building being attributable to building materials and cement alone retailing for N3,500 a bag. To tackle high building materials, we have a few ideas.

- Expand the Rural Investment Allowances to include affordable homes: Nigeria allows 100% tax deduction on the cost of providing CAPEX in rural locations with no facilities (50% if no electricity). This provision should be extended to the urban areas. Developers can claim 100% of the cost to develop affordable homes priced under N5 million per unit.This will enable developers to claw back the cost of building materials. In Kenya, for instance, developers of the $3 billion Tatu City project (commercial and residential estate) targeted tax refunds of up to Sh20 billion on CAPEX to deliver roads, sewerage systems, power lines, and supplying water to tenants.

- Allow cooperative societies and organisations to buy bulk cement for staff housing only and claim tax rebates and deductions.

These proposals will not cost the government cash to implement; the government is forgoing current revenues today and can claw back from property taxes later.

2. Land

Land is expensive in Lagos, Abuja and built-up cities by the simple interplay of demand and supply. It is hard to increase supply, but the government can keep costs low by simply preparing land for development.

Let the government focus on acquiring land, clearing that land, performing sites and services like drainage, then auctioning land to affordable housing developers to build estates. This cuts the cost of building for developers and will become cost savings to buyers.

3. Regulation and taxes; cost of transfers, taxes

Nigeria ranks among the worst globally concerning the cost of registering property and the ease of property registration.

It costs about 70% more than the average for Sub-Saharan Africa and almost three times the OECD average to register a property in Nigeria. According to the World Bank’s Doing Business 2020 report, Nigeria ranks 183rd out of 190 countries.

In Lagos State, property registration costs about 11.1% of the property’s value, with an average of 12 procedures, and can take as long as 105 days to complete. For the sake of comparison, in South Africa, registering a property costs at most 6.1% of the property’s value and requires only 33 days and no more than five procedures.

A good example that can be copied nationwide is Oyo state which has a digitized Certificate of Occupancy (C of O) issuance platform called the Oyo State Home Owners Charter (OYHOC) scheme. OYHOC makes the processing and collection of C of O faster, easier, and affordable. OYHOC generates C of O’s that ease authenticity of confirmation.

It also facilitates property documentation on government digital databases for easy verification and transfer, thus making using properties as collateral for any financial transactions easier. The processing and collection of the Certificate of Occupancy would take only 60 days under the OYHOC scheme. The Oyo state government will bear the price of survey and planning permission.

Amending the Land Use Act will reduce the delays in securing consent by allowing transfers to be validated by the simple contract of sale and then registered in a central database. In essence, eliminate the need for a Certificate of Occupancy.

If I buy shares worth N1 billion, the Governor does not need to sign my share certificates. Create a digital blockchain open registrar to ensure that certificates cannot be faked but can be verified and paid for online.

4. Finance; interest cost of a mortgage

According to the Central Bank of Nigeria (2020) presentation, ‘Financial System Strategy’, the total housing stock in Nigeria is estimated at 10.7 million, with only about 5% in a traditional mortgage.

ThisDay reports that interest rates for mortgages range from 17% to 25% per annum outside these subsidized rates. Maximum loan repayment tenors are between 10 to 20 years, with lenders demanding between 30 to 50 percent equity contribution.

The Federal Mortgage Bank of Nigeria (FMBN) is the only real affordable housing finance window for most Nigerians, and we need more.

The CBN recently announced its plan to inject approximately N500 billion (US$1.3 billion) into the housing sector and is working with Lagos State via the Family Homes Fund (FHF) to manage the execution of a N200 billion to the housing market, again more is needed.

Where will the funding come from?

Housing needs long-term financing. The Pension Commission should allow contributors to deploy pension contributions from their Retirement Savings Account (RSA) to Primary Mortgage Institutions as a down payment.

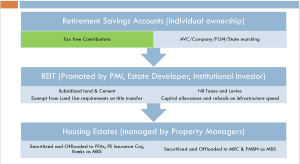

These down payments should form the basis of a Rent to Own scheme where contributors can stay in homes, paying rent, which buys them equity. The RSA funds, primarily the Additional Voluntary Contribution portion, can be directed to the Primary Mortgage Institutions (PMI) but ring-fenced to housing projects, with land, cement, and fiscal incentives.

The number plays out like this. According to the Nigerian Bureau of Statistics, the total adult working population in Nigeria is about 87.9. of this number, using data from Enhancing Financial Inclusion and Access (Efina), 4.5% of this working population earn above N70,000 monthly.

If these groups contribute 10% of their annual salary to their RSA for a “rent to own” scheme, that translates to N332.26 billion annually. This is a down payment that funds the value chain and activates matching funding.

The PFAs then invest in the REIT created by the developers and the contributors in making their monthly pension checks are funding both their homes and retirement

This flow of funds will be invested in REITS promoted by developers who get the tax and subsidies earlier highlighted. A summary of the framework will look like figure 2 below.

Figure 2: Flow of fund to affordable housing

Other success factors

- Removal of all taxes, fees, and levies by Federal, State, and Local Governments accessed affordable real estate development.

- Empowering the commercial banks and Insurance companies by giving affordable housing REITS the same guarantees and provisions FGN bonds get.

- Empowering the FMBN and Refinance Company by increasing their capital base via implicit FGN guarantees, if necessary, to enable them to support mortgage originators by purchasing their securitized Mortgage-Backed Securities.

- Update foreclosure laws.

By Kalu Aja