Recent data from the Lagos branch of the Nigerian Institution of Estate Surveyors and Valuers (NIESV) indicates a substantial rise in prices, activity, and interest within the property market for land transactions in Lagos.

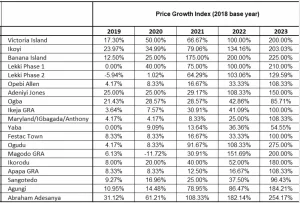

Over the five years period, growth rate in the upper profile was led by Ogudu at 275 per cent, followed by Banana Island at 225 per cent, other parts of Ikoyi at 203 per cent and Victoria Island followed closely at 200 per cent. The lower profile contains locations such as Yaba (55 per cent), Ogba (86 per cent), Sangotedo (96 per cent), Ikeja and Festac town (100 per cent respectively).

The price growth index, using 2018 as the base year, demonstrates significant and varied increases in property prices across multiple locations in Lagos from 2019 to 2023. Victoria Island, Ikoyi, and Banana Island consistently show substantial growth, while Ogudu and Abraham Adesanya experience remarkable increases, reaching up to 275.00 per cent and 254.17per cent, respectively, by 2023. Overall, the data reflects a dynamic and appreciating real estate market in Lagos during this period.

In the overall year-on-year growth pattern trend shows fluctuating growth rates over the five-year period. Notable increases occurred in 2020 (27.87per cent) and 2023 (50.00per cent). Some years experienced negative growth, such as 2019 (-5.94per cent) and 2022 (13.07per cent). Varied growth patterns across the years suggest a dynamic and changing landscape.

The ‘Lagos Land Price Appreciation Index: Market Growth and Price Points’ report released last week, charts the performance of land price movement between 2018 – 2023 shows that over the period of five years (2018 to 2023), Victoria Island and Lekki Phase 1 experienced substantial growth and development, showcasing strong demand for every available one square metre (sqm).

In price growth per sqm in selected areas of Lagos, notable growth areas include Victoria Island, Ikoyi, and Banana Island, each experiencing substantial increases, while Sangotedo, Yaba, and Festac Town show moderate growth. Ogudu stands out with a remarkable CAGR of 30.26 per cent.

Essentially, about 19 locations were considered and adopted based on their level of priority demand for residential, commercial and industrial purposes. These are Ikoyi, Banana Island, Lekki Phase 1, Lekki Phase 2, Opebi, Allen, Adeniji Jones, Ogba, Ikeja GRA, Maryland/Gbagada/ Anthony, Yaba, Festac Town, Ogudu, Magodo GRA, Sangotedo, Agungi and Abraham Adesanya.

The market report focuses on land transactions in selected property markets in Lagos State, from 2018 to 2023. Transaction records for and parcels suitable for development in selected areas are well captured and analysed in the report, including buying, selling, leasing, and transferring ownership within the state’s legal framework.

The report provides the key tools for measuring the investment performance of the Lagos Property Market, by observing the developments, transactions, trends and performance analysis of investment in major locations in the Lagos land market. This will assist stakeholders in assessing the investment profitability, tracking market trends, and providing credible information to make informed land-use and urban planning decisions.

Lagos’ real estate market, a dynamic hub in Nigeria’s commercial landscape, caters to a 20 million plus population. Boasting of a 75 per cent residential market blending traditional and modern structures, the sector turns challenges (infrastructure, regulations) into opportunities for urban renewal. Recent trends showcase heightened demand for high-end properties, smart homes, and sustainable designs.

The report noted that despite obstacles, the market stands robust, promising substantial growth. Navigating this landscape effectively requires a profound understanding of its distinctive dynamics and market support transactions with credible data support.

Specifically, the report finds that land prices in Lagos are steadily increasing, driven by a growing population, limited land availability and high demand for housing and commercial developments. This trend is expected to continue in the foreseeable future.

One of the significant drivers of the Lagos real estate boom is the ongoing infrastructure development, as the government is investing heavily in transportation networks, including road expansion projects, the construction of bridges and the expansion of the Lagos Light Rail System.

The real estate industry in Lagos is embracing technology to streamline processes and enhance the customer experience. Online platforms for property listings, virtual tours, and digital transactions have gained traction, making it easier for buyers and investors to explore options and in making informed decisions.

The report noted that despite the COVID-19 pandemic challenges of 2020, Lagos’s real estate bounced back, emphasising sustainability, affordability and competing use patterns. However, the scarcity of parcels of development land and the competition for prime land for various uses continue to put pressure on land prices within the prime areas of Lagos State.

“From our research, top shot, and mid-prime locations of Victoria Island, Ikoyi, Lekki, GRA Ikeja, Yaba, Ogba, and Maryland saw a mix of high, moderate, and steady growth. From the analysis, Ikoyi leads with a substantial growth and a strong CAGR, while Ogba and Maryland continue to show positive but comparatively moderate growth, reflecting diversified dynamics, according to the Chairman, NIESV Lagos branch, Gbenga Ismail.

He noted that land is responding to inflation and demand is rising, adding that “Lagos, the nation’s commercial capital is experiencing a real estate boom like never before. With its growing population, rapid urbanisation, and flourishing economy, the city has become a hotbed of real estate activity.”

Source: Guardian