Commercial banks in Nigeria have extended their workdays to weekends for customers to deposit their old naira notes.

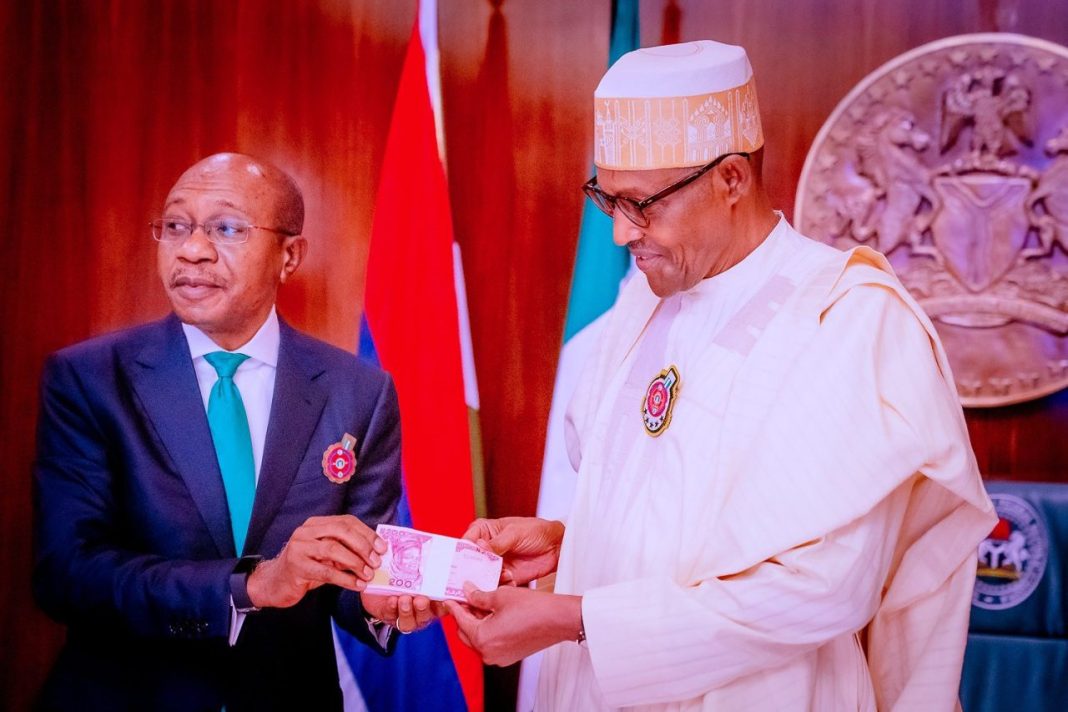

The action is to help customers meet the Tuesday, January 31 deadline set for the collection of old naira notes by the Central Bank of Nigeria (CBN) governor Godwin Emefiele.

With Emefiele and the CBN unwilling to extend the deadline, many fear that over 50 per cent of Nigeria’s unbanked population may lose their cash savings following CBN’s requirement that old notes could only be exchanged through an existing bank account.

First Bank of Nigeria, Guaranty Trust Bank, and other financial institutions have notified customers to visit their branches on Saturday and Sunday to deposit old Naira notes.

“This is to notify the general public that our branches will be open Saturday and Sunday just to receive cash,” one of the banks said in a statement similar to what other financial institutions also sent to their customers.

“All old notes of series 200, 500 and 1000 will cease to be in use from the 31st of January.”

Amid a public outcry and protest over the slow low circulation of the redesigned 200, 500, 1000 notes, CBN insists that will not not extend the Tuesday, January 31 deadline to phase out the old notes.

Nigeria Governors’ Forum (NGF), Bank Customers Association of Nigeria (BCAN) and a host of other stakeholders have expressed concerns and made appeals for CBN to extend the period for the currency swap as well as review of the cashless policy.

The House of Representatives and the Senate in separate resolutions, on Thursday, asked CBN to extend the deadline by six months till July 31.

However, CBN governor Emefiele insists that Nigerians had enough time to deposit the old notes to collect the new ones despite a shortage in supply for new notes by the banks.

“The reason is because we feel 100 days should be enough for those who have the old currency to deposit the money in the banks. And we took every measure to ensure that all the banks were open to receive all old currencies. 100 days, we believe, is more than adequate.”