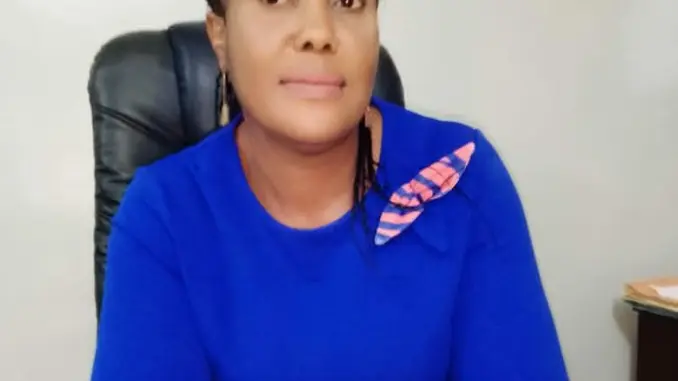

The general manager of Bashmon Homes, Ifeoma Ekwenye, in an interview with SEGUN OGUNEWU gives an insight into the housing deficit problems in Nigeria, and how her firm is helping bridge the deficit.

Tell us about your journey in the sector and how it has inspired your achievement in business?

The critical thing for me is to work hard. If you are close to me, you’ll know that I log in a lot of times. It takes time for you to get things done and it requires a lot of patience and tenacity. I recommend that young people understand that nothing comes easy, so when you see a successful person, know that the person has worked hard to get there. I have watched with keen interest the housing problems in the country and how people had to pay through their noses to secure a decent accommodation. So far so good. It has really been a beautiful, wonderful experience and seeing that we are actually helping people to own their homes through affordable payment. I’m always happy when a customer is satisfied. That is what gives me joy. I will say it has really been a wonderful and a beautiful experience. And if you ask me, we want to do more for the people.

Mortgage in the country has always been an issue for both developers and homeowners. How do you finance all your projects?

Nigeria’s unattractive mortgage system has been a key theme in its residential market for decades. With a housing deficit running into tens of millions, home-ownership rate at 25% and a mortgage financing requirement conservatively estimated between 15-20 trillion naira, there is a great deal of work to be done. Housing is typically capital intensive in Nigeria due to the high cost of construction, surging land prices and excessive financing costs. The high capital requirement of housing has made long-term financing critical in driving affordability; particularly for lower and middle-income groups. However, at Bashmon Homes, our target are the low income earners. We tried as much as possible to bring the price down since our major focus is building affordable homes for the masses. The major key to increasing prices of building materials and difficulty in accessing mortgage facilities is the federal government. No country can boast of economic advancement without the joint effort of the government and private sector. Government must put in simplified policies that will make mortgage facilities more accessible to the people, and by partnering with private players in the industry. As a company, we have partnerships with Polaris Bank and KeyStone bank, this is because my boss retired from the banking industry, and knows the importance of the partnership.

What unique services are you offering that differentiates you from other real estate firms in the country?

We are different from our competitors because our focus is low income earners. In essence we’re not building high rise buildings in Ikoyi or Banana Island for the super-rich; but on bringing smiles to the faces of civil servants, and many other Nigerians who wish to have a decent home over their heads. With N3.5m people can actually get a home from us, move in within a 12-month period, and then spread the balance in the next three years. We also have payment plans that accommodate exigencies for our clients. We have several semi-detached buildings, semi-finished houses that are beautiful and well laid to encourage people to invest in and also take care of their retirement. We are actually expanding and we are building more to make sure it goes round.

What informed your strategy to target that segment of the market?

For us, that’s where the market will always be. Bubble burst market will always be there. It is bubbling and will be bubbling. People will be coming from everywhere to burst in so it will be really difficult, maybe a war situation or real crisis, for the market to thin out within that boundary. For us, that’s where the market is but the challenges too are enormous in serving those kinds of people especially with the kind of funding structure we have available. They have to bring money from their pocket and they don’t have so much because it’s not as if what we are selling is any cheaper, that’s the truth, we are just trying to make it as affordable because there is no support to make it cheaper.

What informs the choice of locations you go to do your development and how does that affect the marketability and affordability of your projects in the long run?

What we generally look at is where development is going, not where it is already. We try to follow sometimes as much as possible the Growth Pole Theory in Real Estate so you find us in axis like Ibeju, Epe, Ikorodu, Atan, Simawa, Mowe, Shagamu, Abeokuta, Ibadan. We also have properties in Delta and Abuja.

We try to follow the growth pole where there are things that can attract and bring people there except if we have enough money (when we start having such money) to now create the pole itself and make people come there.

So at what price would you say an affordable dwelling should cost?

An affordable fenced dwelling should be within the region of anything from about N3.5 million upwards depending on the size of your family. If you are talking of a family that wants to stay in a 2-bedroom, maybe anything from about N3.5 million upwards but people stay in studios and you can get that for much less.